The Best Strategy To Use For Frost Pllc

The Best Strategy To Use For Frost Pllc

Blog Article

The Best Strategy To Use For Frost Pllc

Table of ContentsRumored Buzz on Frost PllcGet This Report about Frost PllcThe smart Trick of Frost Pllc That Nobody is Talking AboutThe 6-Second Trick For Frost Pllc

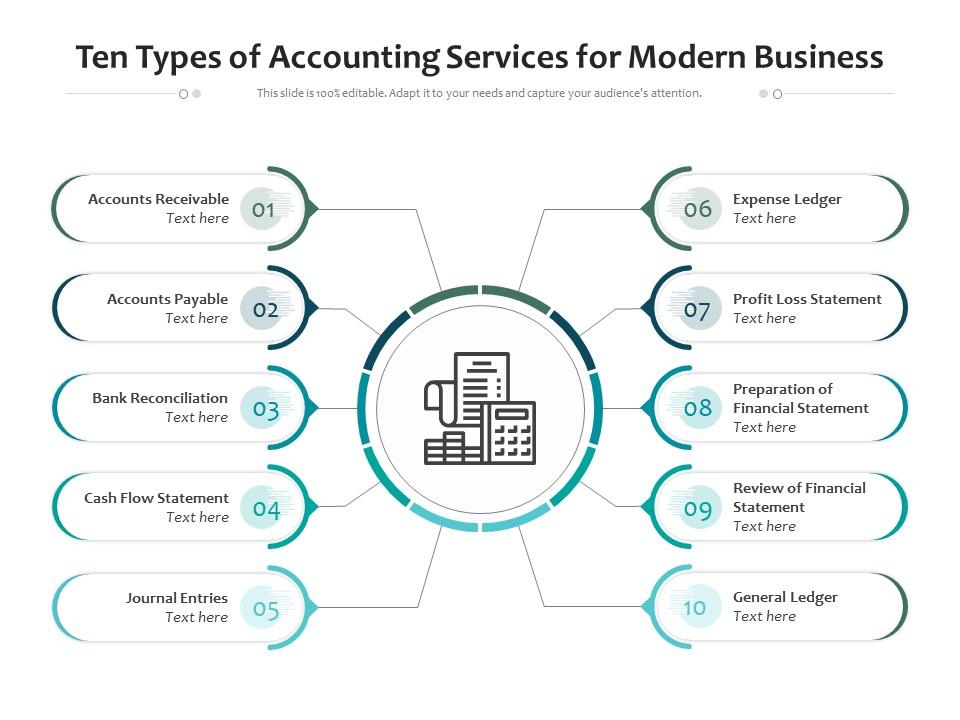

Our bookkeeping firm supplies comprehensive accounting solutions, thoroughly keeping economic records, reconciling accounts, and creating monetary records. This frees up organization owners to focus on core operations. Financial reporting is crucial for business monitoring and conformity. Our accountancy provider uses financial reporting services, preparing and providing economic declarations and reports such as annual report and revenue declarations.Handling payroll can be complex and time-consuming. Our audit company offers dependable payroll services, making certain prompt and exact repayment of staff members, conformity with pay-roll tax obligations, and adherence to work laws. Contracting out pay-roll duties permits clients to concentrate on business development. Financial evaluation and preparation see to it your organization is developed for lasting success.

Our group of tax obligation experts supplies constant tax obligation planning and consulting solutions. We execute tax-saving approaches and make best use of deductions to minimize tax responsibilities. Your bookkeeping provider ought to have the ability to supply a diverse profile of advising and getting in touch with solutions. Each organization has one-of-a-kind requirements and calls for insights pertinent to your particular scenario.

Some Known Facts About Frost Pllc.

Bookkeeping solutions and features are what maintain a business on the right track. After all, the factor of a business is to create earnings, to make sure that suggests a person demands to be watching on the money that is entering and out of the accounts. That's actually just the most standard accountancy services instance.

Typically, company owner wish to trust their instincts regarding choices like acquiring realty, making a new hire, or broadening to a brand-new market. And while instinct is vital in business, often a suspicion isn't the most effective indicator to go on. If the decision-maker doesn't have perspective on the capital, tax responsibilities, and market conditions, a choice that "really feels" right can actually go really incorrect.

If you are among the 23% of small company owner seeking even more means to grow revenue, or the 16% that state getting a handle on money flow is a difficulty, the benefits of collaborating with an accounting professional will show up quickly for your service - Frost PLLC. One more 40% of proprietors say supply chain and supplier expenses have actually boosted during the last six months, while 30% are battling to make full-time hires

To those that just believe bookkeeping is collaborating with numbers, the idea that financial experts can assist a business accomplish so much may be surprising. That's why we'll start at the start by describing the 5 main points an accounting professional does and discuss address every little thing you require to understand to hire the accounting solution that is best for you.

Some Known Factual Statements About Frost Pllc

Right here is how each of these accountancy tasks is differentand crucial. Collecting service financials to recognize the procedures and monetary problem of a company.

When each of these tasks is come close to with self-confidence and organization, the difference for a business can be transformative. Not just are the financials more arranged, but leaders at business feel more certain production choices. This is many thanks to the mixed Full Article power in between accounting and accountancy solutions. Accounting is the foundational essence of good accounting.

Accountants produce a direct document of all the acquisitions a service makes, and the sales deals it makes. Bookkeeping takes the information documented by accountants and provides it indicating. Daily, the books are most likely balanced and whatever looks terrific. What could be far better? What efficiencies could be achieved? And what financial investments or growth decisions will maintain the business growing solid? Several full-service accounting professionals carry out bookkeeping responsibilities too, while various other firms might have professionals functioning in either specialty.

Frost Pllc - The Facts

Each of these kinds of accounting professionals executes the 5 major audit tasks in a different industry or area of specialty: Public Accountancy: This is one of the most extensive type of bookkeeping for companies and people, including analysis of financials, identifying mistakes, pay-roll, accounting, and tax obligation prep work. Federal government Audit: This type of bookkeeping guarantees the purchases, spending, and revenue generation of federal government entities remain in conformity with the regulation.

Handling to Account: These accounting professionals take a service' financial information and apply it to aid with cost management, property monitoring, and employee efficiency examination. Interior Bookkeeping: Total, auditors try to find areas of waste, error, scams, and mismanagement. This can include assessing compliance with tax obligation regulation or work law. Auditors may focus on certain locations like conformity, innovation, or taxes, and can be employed by a company to proactively identify and fix threats.24% of all auditors and accounting professionals in the United States work doing bookkeeping and bookkeeping, payroll, and tax obligation preparation for their companies and/or clients.

Within the four major types of audit features, there are lots of various audit and bookkeeping solutions a firm might provide. Frost PLLC. Some of these solutions, like accounting, accounts payable/receivable, and pay-roll are the foundation of even more sophisticated audit services like tax accountancy, forensic bookkeeping, or tactical preparation.

Report this page